|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Refinance to Buy Investment Property: Strategies and InsightsUnderstanding the Basics of RefinancingRefinancing involves replacing an existing mortgage with a new one, often with better terms. This financial strategy can free up cash, allowing you to invest in additional properties. Benefits of Refinancing for InvestmentWhen you refinance, you can potentially lower your interest rates, reduce monthly payments, and access equity. These benefits can provide the financial flexibility needed to purchase investment properties.

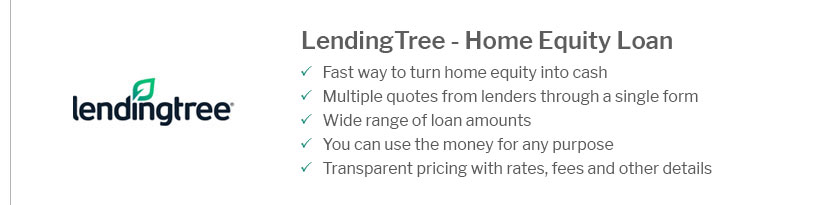

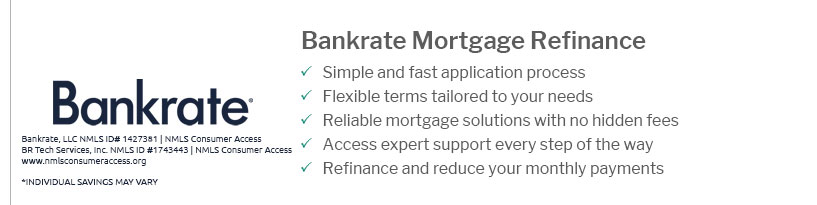

Cash-Out Refinancing ExplainedThis type of refinancing allows you to borrow more than you owe on your current mortgage and take the difference in cash, which can be used as a down payment for an investment property. How to Choose the Right LenderFinding the right lender is crucial. You can compare options by reviewing best home refinance company reviews to ensure you select a lender that offers competitive rates and favorable terms. Steps to Refinance and Buy Investment Property

To explore current refinancing offers, visit best home refinance deals. FAQs on Refinancing to Buy Investment PropertyWhat is the best type of refinancing for buying an investment property?Cash-out refinancing is often the best choice as it allows you to access equity and use it for investment purposes. Can I refinance a rental property to buy another investment property?Yes, refinancing a rental property can provide the funds needed to purchase additional investment properties. How does refinancing affect my credit score?Refinancing may temporarily lower your credit score due to the hard inquiry but can improve your score in the long run with consistent payments. https://learn.roofstock.com/blog/cash-out-refinance-to-buy-rental-property

Pros and cons of refinancing to buy a rental property - You can have a bigger down payment to buy a rental property by combining the cash pulled ... https://www.discover.com/home-loans/articles/cash-out-refinance-to-buy-investment-property/

Using a cash out refinance to buy an investment property may offer savvy investors the opportunity to generate income or acquire property at attractive rates. https://www.reddit.com/r/realestateinvesting/comments/14ectf9/i_dont_understand_benefit_to_cash_out_refinancing/

Another question, when you cash out refinance on one property to put towards another property, are you also taking out another mortgage on ...

|

|---|